Table of Content

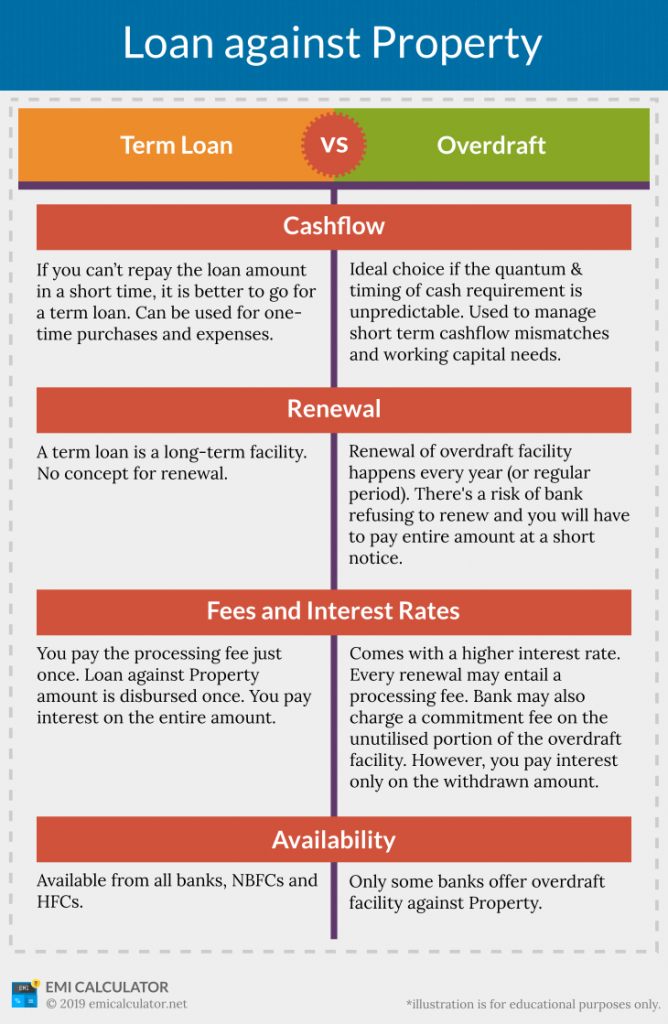

Eligible firms will include Sole Proprietorship, Partnership, and Private Limited Companies involved in services, trading, and manufacturing. Due to the uncertain financial conditions, it is expected that the number of individuals... Yes, Now it is possible to take loan against warehouse property under LAP as well as LRD. Yes, you can avail up to 90% of the total LAP as an overdraft.

You can avail of a home loan for a maximum tenure of 30 years. The bank charges you a processing fee of 050% to 2% of the loan amount. This is nothing but a 2.0 version of the home loan part payment. You can deposit and withdraw the same from a home loan overdraft facility, unlike a normal part payment where the surplus funds go into making home loan payments alone. So, this is clearly for those seeking liquidity else servicing debt obligations at a higher rate won’t be of any worth.

ICICI Loan Against Property Interest Rate - In Case of Variations

SBI home loan is available at 9.15 percent while women borrowers will get it at 9.10 percent interest. Besides the Loan Against Property, ICICI Bank offers the facility of Lease Rental Discounting. The bank considers all the part-payments made in the year preceding the date of foreclosure of the loan for calculating the penalty. Thus if a borrower forecloses a loan on March 31, 2020, all the part prepayments made from April 01, 2019, will be subject to a pre-payment penalty. These amounts will not include the regular loan instalments that the borrower pays during the year.

Any businessman or individual can apply for an OD when they want to fund any unplanned expenses. Read further to know about interest payments in an Overdraft Facility. The ICICI Overdraft facility is available at your convenience. You can apply for an Overdraft facility through Internet Banking or the IBizz app of ICICI Bank, and you can also get assistance from their customer service regarding the same.

Canara Bank Home Loan Plus

Repaying a home loan is tough on the pocket, and at times, you might even miss paying your instalments on time. The late payments, besides impacting your credit score, will also involve additional charges. The repayment period for a home loan typically ranges from 6 months to 30 years. The repayment period may be shorter or longer if you take out a mortgage with a longer tenure.

The rate of interest can be slightly higher compared to a normal home loan. Yesterday, ICICI Bank launched a product for the salary account holders who have taken a loan from it, offering credit from Rs 5 lakh to Rs 1 crore against property owned by them. The product, 'ICICI Bank Home Overdraft', offers dual advantage of a term loan as well as an overdraft facility, the bank said in a statement. Beginning from a minimum of Rs 5 lakhs to a maximum of Rs 1 crore, customers will have the facility to avail a minimum 10% of the total amount as term loan and maximum 90% as overdraft. ICICI loan against property interest rates start at 8.35% p.a for up to 70% of property value. Apply online lowest ICICI LAP interest rate and enjoy fast approval & disbursal, affordable EMI options, extended tenure of 15 years & additional overdraft facility.

#PoweringLife: A CSR Initiative By Volvo India

The rate of interest on the personal loan is higher than that of the loan against security. The method followed by ICICI Bank is a better one because it considers the payments made into the account during the current month while calculating the interest payable for that particular month. Therefore, the borrower gets the benefit of interest for the EMIs that they pay during the month. ICICI Bank permits borrowers to convert from one rate structure to another subject to payment of conversion charges. Yes, it is very much possible provided either buyer of the property takes over the loan liability or customer make the payment of the balance amount.

If you do not have the necessary CIBIL score in your favour or if your requirements are more, the Loan Against Property is a viable option. ICICI Bank offers Loan Against Property to meet your individual and business needs. The lender would calculate the interest cost after deducting the surplus in the savings / current account from the outstanding home loan account. This, borrowers would derive the benefit of making prepayments without sacrificing liquidity.

I like to gain every type of knowledge that's why I have done many courses in different fields like banking, finance, and business. The provisional sanction letter issued by the bank remains valid for 6 months from the date of issue. After this period has elapsed, you will need to submit a new application and provide additional documents. ICICI plot loans are a great way to finance the purchase of land or a plot.

The interest rate charged on the overdraft facility depends on the bank and the amount you are drawing. If you are an ICICI Bank customer with a salary account, you can now apply for a pre-approved home loan facility that offers instant sanction. This new facility offers borrowers low-interest rates and easy credit evaluation. Fresh home loan borrowers having restricted liquidity can opt for the home saver option, a home loan variant.

No, ICICI Bank offers the same rate of interest structure for salaried and self-employed persons. Prepayment charges are only applicable on the full repayment of the loan. Yes, it is possible , provided minimum 10 % of the loan amount should be Term Loan.

If you’re ready to take the plunge and purchase your first home, I highly recommend checking out the ICICI Bank home loan option – it’s sure to make your dream come true. The interest rate for ICICI Home Loan is variable and changes depending on the credit score of the borrower and the tenure of the loan. Salaried and Self-employed individualsExtraa Home LoanMiddle-aged salaried individuals up to 48 years of age. According to analysts, the rate reduction effected by large players would put pressure on others to follow suit to remain in the competition. The entity's current-year performance and projected turnover will be required on the entity's letterhead.

Solution to those holding a Salary Account with the Bank. A loan against property offers you maximum liquidity value for your property. By choosing a long-tenure property loan, you get lower EMI option and ease of repayment. A personal loan is a fantastic solution if you require funds in an emergency.

They are available in different amounts and with different terms, so you can find one that best suits your needs. The ICICI Extraa Home Loan scheme provision of increasing the repayment period to 67 years of age of the applicant for enhancing the home loan amount by 20%. The enhanced loan amount and the repayment tenure is backed by Mortgage Guarantee.

No comments:

Post a Comment